The largest provider of business education in Africa and one of the largest in the world

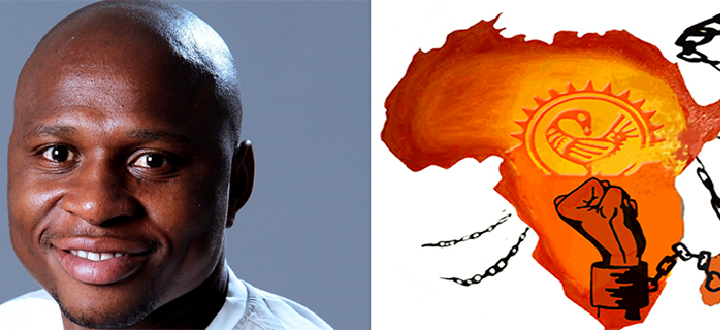

Rolland Simpi Motaung is the founder, educator, and facilitator at Trymph Education - an education company that offers private tutorials to tertiary students and business consultancy.

Rolland Simpi Motaung

Motaung is also a book and movie reviewer and a digital content creator. His works have been widely published in various publications, including CityLife Arts, Culture Review and the Mail & Guardian. He recently reviewed media personality and author Johanne Joseph's Children of Sugarcane in the City Press newspaper, which received impressive responses.

He describes himself as a rural and township boy raised by his maternal grandparents. He was born in a remote rural area outside Warmbaths called Rugstersloot and later moved to Mabopane township, outside Tshwane. Growing up in the rural came with challenges, including no electricity, flushing toilets or running taps, and walking hours to school. Despite such, Motaung states that the rural setting taught him self-reliance, problem-solving, patience, and how to enjoy nature's peace – priceless lessons that continue to shape his adulthood.

Living in Sunnyside posed an unsavoury challenge for Motaung, who, in his first year, did a BCom Management degree with Unisa but struggled with time management and losing track of his studies due to negative peer influence.

He explains: "Coming from a rural and township background, urban life was faster and louder; thus, I got lost in all the hassle of trying to find my feet." He continues: "Years later, when I did my Bachelor of Commerce Honours in Business Management degree, I got married, became a father and an entrepreneur, so the challenges were balancing studies, family, and a growing business. However, I eventually conquered and was able to register for a Master of Commerce in Business Management degree, which I am currently doing."

Motaung also volunteered at Unisa Radio from 2008 until 2012 as a content producer and later a presenter during his undergraduate studies. In that journey, he said he met incredible and passionate people and learned about the media space and how to package stories. He states, "It was an exhilarating experience that I will always cherish. My main intention in radio was to promote African arts and lifestyle issues, something I am still utterly passionate about."

Mesmerised by literature

Growing up, Motaung says her mother shared African literature with him, such as Tsitsi Dangarembga's Nervous Conditions and The Beautyful Ones Are Not Yet Born by Ayi Kwei Armah, among others. In high school, he delved more into African literature, captivated by authors such as Bassie Head, Es'kia Mphahlele and Fred Khumalo.

While studying and starting his entrepreneurial journey, Motaung got introduced to the business, leadership, and financial literature. He says this was won over by a leadership book by Mteto Nyati's Betting on a Darkie, excited that Nyathi's story would also reinvigorate Trymph education's students towards their business studies and careers.

Adding a light of hope to others

"I aim to add positivity to people's lives. I would have fulfilled my purpose if I could improve people's lives, especially previously disadvantaged African people. So, through teaching, writing, media, or arts, the aim is to plant a smile and revitalise hope in one's spirit for us to grow and be the best we can be," he states.

Unisa shaping futures

Motaung says education is a liberator, and having an institution that has offered tools to a nation for all these years is an enormous achievement. He says: "May Unisa continue to sharpen its efforts in offering quality education for young and old minds to be liberated from the poverty of the mind."

A message of inspiration to students

Motaung says teaching students to think positively or express positive energies is not enough. He states that these must be turned into practical endeavours, such as proper time management to balance studies, family, work, and social life. He continues: "It is tough for many students studying through an open-distance institution. Therefore, keeping a positive student mentality is necessary, but this should be demonstrated practically."

#Unisa150 #Unisa150Stories

*By Godfrey Madibane, Acting Journalist, Department of Institutional Advancement

Publish date: 2023/05/02

Unisa celebrates a project of hope, dignity and student success

Unisa celebrates a project of hope, dignity and student success

Women vocalists take top honours at Unisa's globally renowned showcase

Women vocalists take top honours at Unisa's globally renowned showcase

African wealth is dependent on investment in education and development

African wealth is dependent on investment in education and development

Unisa celebrates matric result success at Correctional Services ceremony

Unisa celebrates matric result success at Correctional Services ceremony

Unisa ICT Director recognised among acclaimed IT leaders

Unisa ICT Director recognised among acclaimed IT leaders