News & Media

College of Accounting Sciences budget overview 2019: South Africa desperately needs economic growth

Prof Sharon Smulders (Department of Financial Intelligence, College of Accounting Sciences) presenting an overview of the 2019 Budget speech as delivered by the Minister of Finance.

"Certain commentators referred to this year’s budget as a 'pressure cooker' budget in that the government had to confront its challenges and rebuild the nation’s confidence." These were the words of Unisa’s Prof Sharon Smulders from the Department of Financial Intelligence in the College of Accounting Sciences (CAS) at the college’s budget overview 2019 event.

Smulders presented her overview of the 2019 Budget speech that was delivered by Finance Minister Tito Mboweni on 20 February 2019.

The South African landscape is faced by, inter alia, severe poverty and inequality, an unemployment rate of 27.1% (official December 2018 statistics), and the erosion of tax morality, resulting in the decline of trust that taxpayers have in the Revenue Authority. South Africa’s gross domestic product (GDP) has an expected growth of only 1.5% for 2019, compared to the rest of Africa. For example, sub-Saharan Africa is expected to grow from a GDP rate of 3.1% in 2018 to 3.6% in 2019/2020.

The budget deficit has increased to a significant amount of R243 billion, with an expected increase in revenue of 29.3% and an expected higher increase in expenditure of 33.7%. The bulk of the revenue (75%) needs to be raised from taxes, of which personal income tax contributes the largest portion (R552.9 billion). Of a total population of approximately 57 million people, only about 14 million people are registered taxpayers, of which almost half receive taxable income below the tax threshold. This means that only 13% of South Africa’s population is paying income tax.

How is your pocket affected?

Budget expenditure increased with 9.7% from 2018 to 2019. The single biggest expense is education, totalling R386.4 billion, of which R250.4 billion is spent on basic education, even though South Africans currently have the worst literacy level in the world. Debt-service costs grew with 10.7% and will grow even more with any increase in the budget deficit. South Africa is currently paying R1 billion per day in interest on government debt.

As indicated in the Auditor General Report for 2017, irregular expenditure, calculated over a period of four years, increased by 55% (R45.6 billion). The Auditor General Report for last year reflected an increase of 70% (R72.6 billion).

Eskom and other state owned enterprises (SOEs) are operating at a loss. An additional R69 billion (R23 billion over three years subject to certain conditions to be met) is allocated for the restructuring of Eskom. This amount will primarily be funded by higher income tax revenue and projected savings generated by the early retirement of an expected 30 000 public servants, which will cost R16 billion but is expected to reduce the public sector wage bill by R20 billion over the next three years.

On the personal income tax front, no changes to the income tax rates were announced, but the tax rebates were slightly increased. A taxpayer may still pay more income tax in the coming year. If an employee, for example, receives a salary increase that moves him to a higher tax bracket, the employee will actually be paying more income tax for the year of assessment.

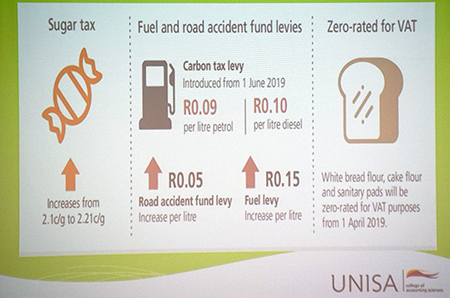

No additional relief was provided in respect of interest income and medical expenses. VAT remained at 15%, but some additional items (white bread flour, cake flour and sanitary pads) will be zero-rated from 1 April 2019.

Alicia Heyns (Financial Intelligence), Stanley Msimango (Marketing Assistant: CAS), Hermanus Combrink (Financial Governance), Prof Sharon Smulders (Department of Financial Intelligence, CAS) & Pixie Vorster (Financial Intelligence) |

Prof Lungile Ntsalaze (Acting Executive Dean: CAS) raises an issue at the budget overview 2019 event. |

An interesting fact is that the increase in the existing fuel levies combined with the new carbon fuel levy (to be introduced from 5 June this year) will result in 41.8% of the pump price of petrol and diesel representing taxes. Another interesting fact worth mentioning is that ad valorem taxes will be levied on television sets, monitors, and gaming consoles screens bigger than 45 cm in diameter.

In conclusion, South Africa desperately needs economic growth. However, in the words of Smulders: "We have so much potential in this country, we cannot afford to give it away. We are all stakeholders in the SOEs and we have rights and obligations. We need to make our voices heard so that we can again become the number one country in Africa and the world."

* By Alicia Heyns and Pixie Vorster, Department of Financial Intelligence, College of Accounting Sciences

Publish date: 2019/03/04

Unisa co-hosts G20 community outreach in the Eastern Cape

Unisa co-hosts G20 community outreach in the Eastern Cape

Unisans gain membership of prestigious science academies

Unisans gain membership of prestigious science academies

Advocating for disability transformation through servant leadership

Advocating for disability transformation through servant leadership

Unisa Press continues to illuminate the publishing space

Unisa Press continues to illuminate the publishing space