News & Media

Creative Unisans conquer investment challenge

Keeping their eyes on the prize, Unisa’s Value Creators Team, innovative students Khanyisile Ndlovu and Junior Mahlangu, have won the Johannesburg Stock Exchange (JSE) Investment Challenge in the Spectacular University Category for two consecutive months (July and August 2022), and have made it to the top three of the overall rounds where the results will be announced soon. Ndlovu and Mahlangu are both pursuing their honour’s degrees in accounting at Unisa.

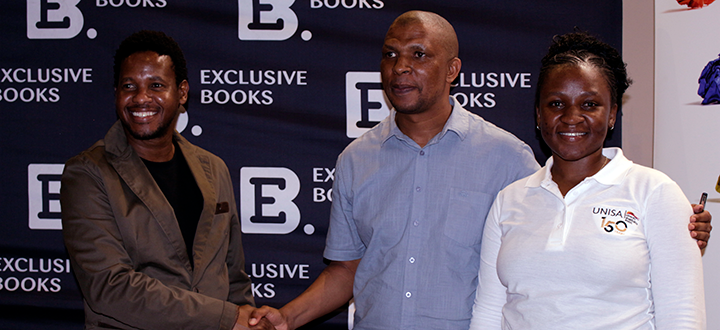

Khanyisile Ndlovu and Junior Mahlangu

The challenge teaches students about investing on the JSE, the fundamentals of investment strategy and the role that investment plays in the country's economy. In the Spectacular University Category, the participants can trade on most instruments available on the JSE, including the derivatives market where they can trade in the futures and options market.

Speaking on how the Value Creators name came about, Ndlovu says: "It is tied to the purpose of investing in the stock market. Investors buy shares with the purpose of adding value for themselves." She adds: "The name also speaks to our enthusiasm to learn how to create long-term value for ourselves and future generations."

Victory that unlocks opportunities

Team leader, Mahlangu, says that as a future fund manager, the victory indicates that he has a potential to generate good returns for clients that he will be serving. He adds: "As a team, it means that the research techniques that we applied are in order. We were able to generate good returns in a very unstable market environment."

According to Ndlovu, winning the challenge provides her with an opportunity to understand better the concept of investing beyond theory. "It shapes my perspective on what to venture into in my accounting career," she says. Ndlovu continues: "Winning this as a team shapes our careers, exposes us to different business models, and opens opportunities that we were unaware of in the investment world."

Explaining the strategy they employed, Mahlangu says: "We mainly traded on the derivatives market as the instruments are leveraged at a rate of 1:3,33, allowing us to have more market exposure, take long (buy) positions on companies we believe would perform well, and short (sell) positions on underperforming companies."

Among others, a long (buy) position compares net asset values and shares companies’ prices to see enterprises trading at discount. On the contrary, a short (sell) position analyses companies’ audit reports to identify those with adverse or negative reports to detect possible frauds and misstatements.

Unisa is a good foundation for growth

Mahlangu states that Unisa is the best institution to further his studies as it is affordable and at the same time, does not compromise his study objectives. "I enjoy being a Unisa student as distance learning is flexible, so students can study at their own productive pace. This allows me to also focus on my invention, Mwanzo Learning, a value-orientated online tutoring enterprise that will launch in early 2023," he adds. "Also," he continues, "the institution’s College of Accounting Sciences has a rich history of producing outstanding leaders such as Sizwe Nxasana, the co-founder of SizweNtsalubaGobodo and former Chief Executive Officer of Telkom Group and FirstRand Group."

In addition, Ndlovu says that studying at Unisa enables her to juggle her studies and work. She maintains: "It provides a good foundation for growth and discipline, as it takes discipline to prioritise and have a good balance." She adds: "While I have had a roller coaster experience, the lecturers’ involvement makes it easy to submit my academic work on time."

Ndlovu encourages students to keep working hard and to be dedicated. "Each person has to conquer their own storm and shine," she concludes. "Study smart, manage your time and ask for help prior to examinations."

* By Nancy Legodi, Acting Journalist, Department of Institutional Advancement

Publish date: 2022/10/24

Unisa co-hosts G20 community outreach in the Eastern Cape

Unisa co-hosts G20 community outreach in the Eastern Cape

Unisans gain membership of prestigious science academies

Unisans gain membership of prestigious science academies

Advocating for disability transformation through servant leadership

Advocating for disability transformation through servant leadership

Unisa Press continues to illuminate the publishing space

Unisa Press continues to illuminate the publishing space