College of Economic & Management Sciences

Budget 2022: Government should face SA’s problems head-on

Tony Ehrenreich

The extremely high unemployment rate, the increasing expenditure on social support grants, the need for more money for the National Prosecuting Authority and South Africa’s future ability to service its debt came under fire during the College of Economic and Management Sciences’ fourth Budget Discussion on 25 February. A panel of five representatives from labour, the private sector, the international organisation EcoMod and academia participated in the discussion.

There was general consensus that the tax windfall from the surge in commodity prices in 2021 brought budget relief in the short term but that concerns remained for the long term.

Government’s inability to come up with far-reaching realistic plans was also criticised by the panel.

Unemployment

The unemployment rate of 70% among the youth has a huge impact on stability and investment in the country, Tony Ehrenreich from Cosatu argued. He urged government to create an environment that is more conducive for job creation.

South Africa is more unequal today than in 1994. After 27 years of ANC rule, poverty has increased despite efforts by government.

The budget is the one tool government can use to redistribute, but Ehrenreich was of the opinion that this budget does not deal with the scale of the country’s economic problems. During the State of the Nation address the President focused on the past with no sign of any bold moves, no stimulus and no new deal. There was also no reference to real structural changes, Mr Ehrenreich pointed out.

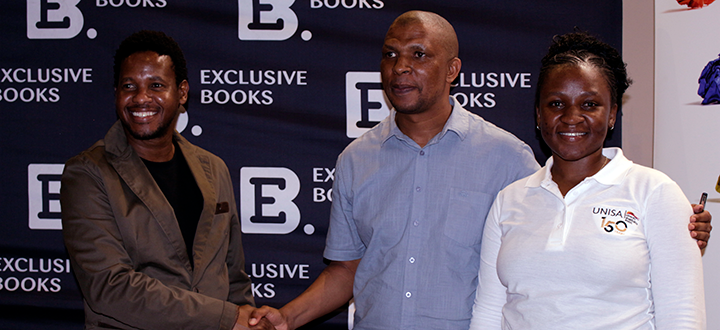

Mzwanele Ntshwanti

Mzwanele Ntshwanti from Unisa’s Department of Economics maintained that government should be realistic and forget about so-called smart cities. Changes should not only be cosmetic. He accused government of not being serious about facing the country’s economic problems head-on.

He suggested that government invest money where the people are living. There are no sustainable job opportunities for people in the areas where they are needed; therefore, young people are emigrating. Government should go back to the small towns where there is stagnation and no economic activity. Funds must be made available to SMEs where needed. They must be given an opportunity to grow, Mr Ntshwanti said.

Social support

According to Sanisha Packirisamy, an economist at Momentum, 3,3% of government spend is on social support. While this is important for social cohesion, it is not sustainable. South Africa’s spend on social support is far more than that of other emerging market economies. In countries in a similar situation, there are conditions for these grants, she said.

The extension of the relief grants is a response and cannot be a permanent solution. The current grant is not even enough to cover basic food necessities, Ehrenreich said.

State-owned enterprises (SOEs)

The unbudgeted bailouts for SOEs are another concern in Packirisamy’s view. These organisations showed an average return on equity of -16% for 2020/21. Productivity at these enterprises is low and faster changes are necessary, she warned.

SOEs such as tertiary institutions, Transnet, Eskom and others are great functioning entities serving social needs, Ehrenreich said. However, they are disasters in themselves as they should add value but because of large-scale corruption, they have become a burden.

Sanisha Packirisamy |

Prof Boela Swanepoel |

Dr Fanie Joubert |

Referring to corruption and fraud, Professor Boela Swanepoel, Acting Chair of Unisa’s Department of Taxation, said that accountability remains a problem. There must be the political will to bring people to book. Taxpayers are willing to pay higher taxes, but they want to know their money is being spent wisely, he said.

Debt levels

Packirisamy highlighted that while the predicted debt fell to lower levels from November 2021 to February 2022, the cost of servicing debt remained elevated.

Swanepoel also warned that the commodity price increase was not sustainable and that less tax to service debt would be collected in future if the economy did not grow.

In his address Mitja Čok, Professor of Public Economics at the University of Ljubljana, Slovenia and a senior public finance advisor at EcoMod, concurred and said that while SA’s gross debt is smaller than the debt of many EU countries, SA pays significantly higher debt service costs. At the same time, the projected economic recovery in SA is slower and the deficit higher compared to most EU countries. According to EcoMod’s forecast, the cost of debt compared to the country’s GDP could reach 5%, he said.

Comparing the country’s debt to that of others, he argued that the public finance system in SA reveals a higher vulnerability than systems of most EU countries, especially from a public debt point of view.

Government’s wage bill

There is work to be done on government’s wage bill in terms of the head count as well as the increases for government employees. While it is difficult to employ fewer staff in education, health and security, there should be a link to productivity, Packirisamy argued.

At municipal level the debt is high and the capacity low, she said.

Tax on fuel and liquor

For the first time in 32 years the fuel price levy was not increased, as Swanepoel reminded us. He warned, however, that the Russian-Ukraine situation may put pressure on the oil price.

He referred to concerns regarding the illicit trading in liquor that escalated during the pandemic lockdown. This resulted in 20% of the liquor trade being illegal. This has created a situation where the more government increases the tax on liquor, the less income it brings in as people turn to the black market, Swanepoel said.

* By Ilze Crous, Communication and Marketing Specialist, College of Economic and Management Sciences

** Teaser image: News18

Publish date: 2022/03/03

Unisa co-hosts G20 community outreach in the Eastern Cape

Unisa co-hosts G20 community outreach in the Eastern Cape

Unisans gain membership of prestigious science academies

Unisans gain membership of prestigious science academies

Advocating for disability transformation through servant leadership

Advocating for disability transformation through servant leadership

Unisa Press continues to illuminate the publishing space

Unisa Press continues to illuminate the publishing space