The largest provider of business education in Africa and one of the largest in the world

Economics is a social science, and as such, it develops and becomes more sophisticated in ways that frequently correspond with changes in the larger society.

One could say it is expected of a committed student of economics to want to stay on the cutting edge of the field as it develops to better comprehend the underlying dynamics.

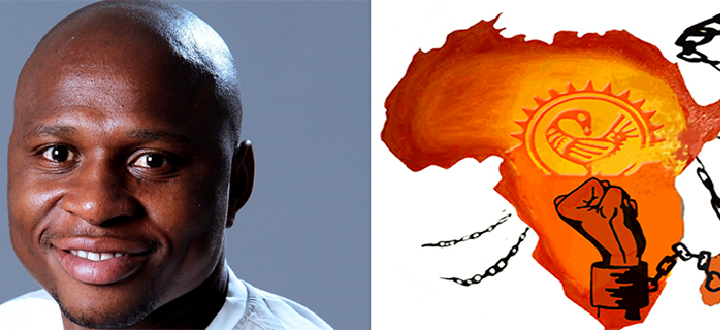

Dr Moeti Godfrey Damane

It is against this background that Economist, Dr Moeti Godfrey Damane felt that getting a PhD in Economics at Unisa was the best course of action.

Furthermore, through his PhD, Damane aims to solidify his foundation and become more knowledgeable in his current role as a Senior Macroeconomic Advisor to the Executive Director of the Africa Group 1 Constituency at the International Monetary Fund (IMF), and in addition, any other role where he may be asked to present well-informed opinions and arguments on macroeconomic issues.

On 4 June 2024, Damane received his PhD in Economics from Unisa. He completed his PhD in two years (2022-2023), under the supervision of Prof Sin-Yu Ho in the Department of Economics, College of Economic and Management Sciences.

"Integral to my success has been my ability to set clearly defined, quantifiable, attainable and time-bound goals. However, the importance of having had the support and direction of an experienced mentor and supervisor who shared my vision and enthusiasm for the work at hand cannot be discounted," acclaimed Damane.

Damane’s thesis empirically investigated the impact of financial inclusion on the financial stability of the banking sector across 37 sub-Saharan African (SSA) countries using data from 2005 to 2019.

The PhD study aims to understand how increasing access to financial services (financial inclusion) affects the stability of the banking sector in these 37 countries.

He utilised various econometric methods to analyse the data and found that financial inclusion positively and significantly impacts financial stability, especially in countries with lower levels of financial stability and economic development.

The study also highlights the importance of policy measures to promote financial inclusion in a safe and sustainable manner.

Damane says the motivation behind this research is driven by the crucial role that the financial sector plays in allocating resources within an economy. "Financial stability is essential for this function to be carried out sustainably," he said.

Given that SSA is a developing region with limited studies on this topic, Damane aims to fill this gap by exploring the link between financial inclusion and financial stability. This understanding is particularly important for policymakers to design effective strategies to enhance financial inclusion and stability in the region.

With the aim to provide a foundation for policies that can foster a more inclusive and stable financial environment, and to ultimately contribute to the broader economic and social development of SSA countries, the research study is set to make meaningful impact on both the academic and policy fronts.

Dr Moeti Godfrey Damane during his graduation ceremony

By demonstrating the positive effects of financial inclusion on financial stability, his scholarly work provides evidence that can help policymakers design strategies to promote economic development in SSA countries.

The findings can guide policymakers in creating regulations and initiatives that enhance financial inclusion, ensuring that more people have access to financial services.

Furthermore, the study emphasises the importance of increasing financial literacy among low-income households, which Damane says can lead to better financial decision-making and improved economic outcomes.

By promoting financial stability through inclusion, the research supports sustainable economic growth, which can lead to improved living standards and reduced poverty in the region.

Concluding his message, Damane stated that he remains committed to using his research to drive positive change, both within the academic community and in the real world, by influencing policies and practices that promote financial inclusion and stability in Sub-Saharan Africa,” he said.

* By Mpho Moloele, PR and Communications, Department of Research, Innovation and Commercialisation

Publish date: 2025/01/15

Unisa celebrates a project of hope, dignity and student success

Unisa celebrates a project of hope, dignity and student success

Women vocalists take top honours at Unisa's globally renowned showcase

Women vocalists take top honours at Unisa's globally renowned showcase

African wealth is dependent on investment in education and development

African wealth is dependent on investment in education and development

Unisa celebrates matric result success at Correctional Services ceremony

Unisa celebrates matric result success at Correctional Services ceremony

Unisa ICT Director recognised among acclaimed IT leaders

Unisa ICT Director recognised among acclaimed IT leaders